How to Pay For

Long term care is often an unavoidable and unaffordable reality for countless families––not to mention the emotional effect of placing a loved one in long term care. Whether care is provided in a hospital, nursing home, assisted living facility or in the familiarity of one’s own home, long term care comes with a hefty price tag that many families simply aren’t prepared to cover.

10,000 people turn 65 every day in the United States, and 75% of them will need expensive long term care support during their lifetime. It’s common for families to rely on multiple financing sources to cover the cost, such as personal funds, private financing, or government programs. Some families may even require around-the-clock care that can run into the tens of thousands of dollars per month. Not even the best financial plan is prepared for a hit like that.

That’s why Retirement Genius set out to create a novel solution to an old problem. We’ve helped thousands of people navigate the difficulties of paying for long term care using an LTC-Life Settlement, and we aim to help you do the same.

The Solution

Life insurance is a valuable asset that can be sold for cash that can be used to fund long term care, supplement retirement income, pay medical bills, or anything else you choose. On average, policyowners who sell their policy receive four times more than they would from any accrued cash surrender value. You can even sell a portion of your policy while maintaining coverage with no future premium obligations.

With Retirement Genius, the owner of an unwanted or unneeded life insurance policy can settle their asset to help them pay for Senior Living and Long Term care through a Life Settlement. This unique transaction is designed to help seniors who are struggling with aging and declining health get value from their life insurance policy instead of abandoning it after years of premium payments. The policyowner will sell their policy and use the funds to open an LTC Benefit Account that will pay for any form of care they want at whatever amount they need for as long as the account remains open.

Who Qualifies?

Age 65+

The minimum age to qualify is 65, though younger insureds with significant health impairments may qualify.

$100,000+

Any policy type – including term – with a death benefit of $100,000 or more could qualify. There is no maximum death benefit.

Health Change

While a decline in health isn’t always necessary to qualify, health impairments may increase the market value of your policy.

Helping a Mother Move into Assisted Living

Faced with a need to reside in an assisted living facility––but without the funding to do so––a family in need contacted Retirement Genius.

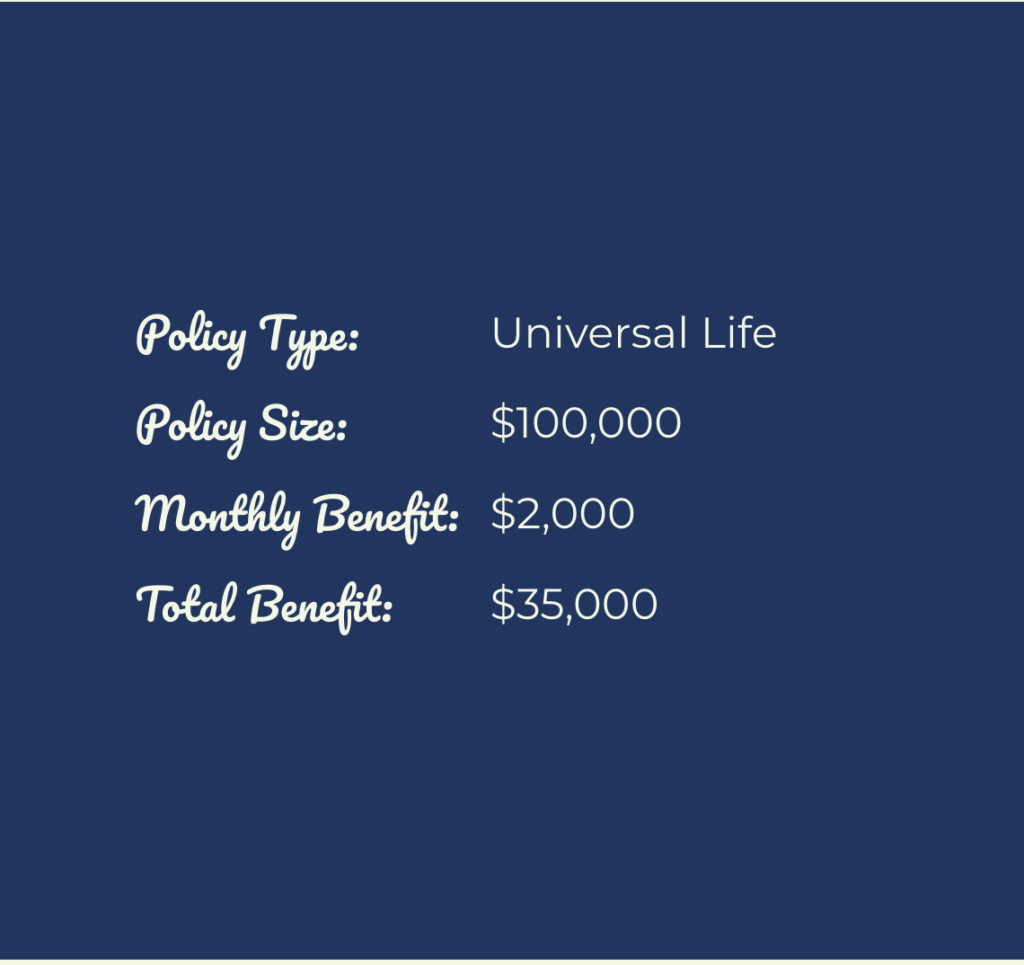

Within 30 days of policy submission, the family was able to turn the $100,000 Universal Life policy they were planning to surrender into a recurring $2,000 monthly long term care benefit for the insured’s lifetime.

Combined with the funding already set aside for retirement, the family was able to place their mother in her top Assisted Living facility choice where she would have the assistance she required and the comfort of having relatives in the same facility.

Affording Long Term Care

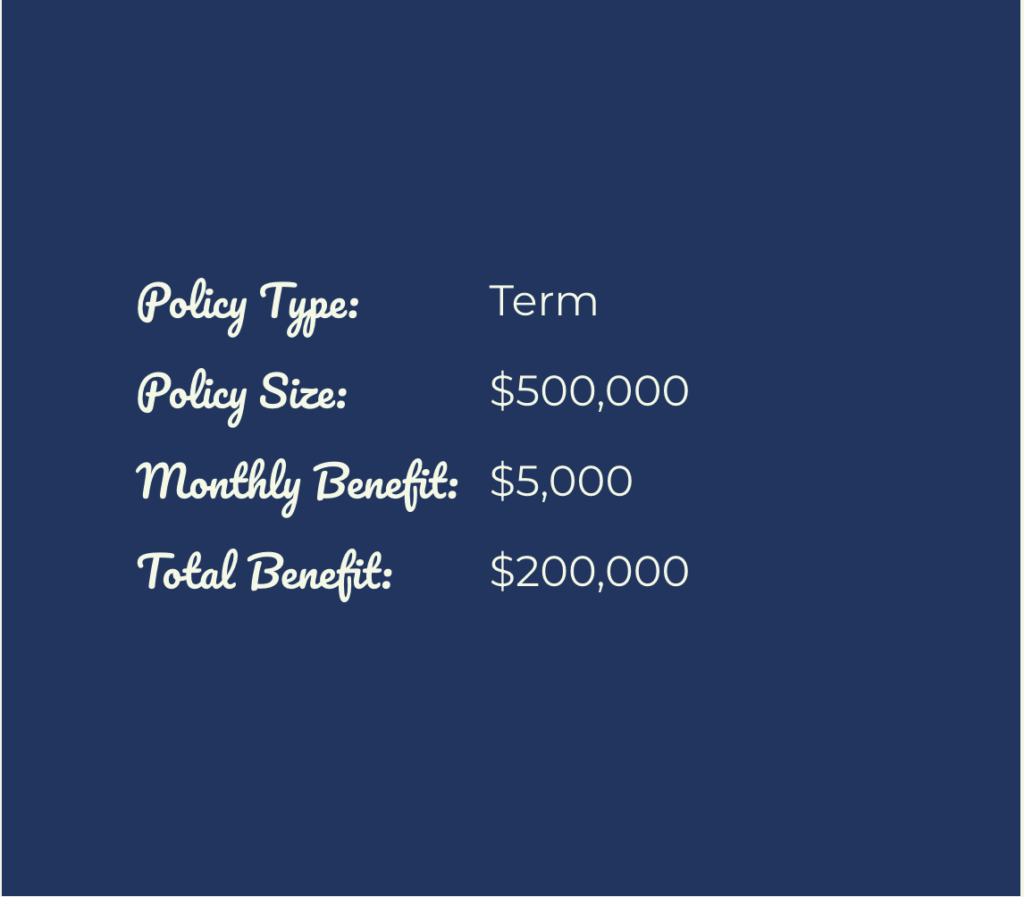

After completing an extended six-week stay at a rehabilitation facility, the policyowner was faced with added financial complications as he could no longer afford the premiums for his $500,000 Term policy.

Rather than lapsing the policy for nothing, his advisor reached out to Retirement Genius. We enabled the policyowner to receive $5,000 monthly payments totaling $200,000, which he used to fund long term care.

Son Helps Mother Before His Deployment

Struggling with funding assisted living for his mother and a time crunch to find a resolution before his deployment to Afghanistan, a son was faced with a difficult situation.

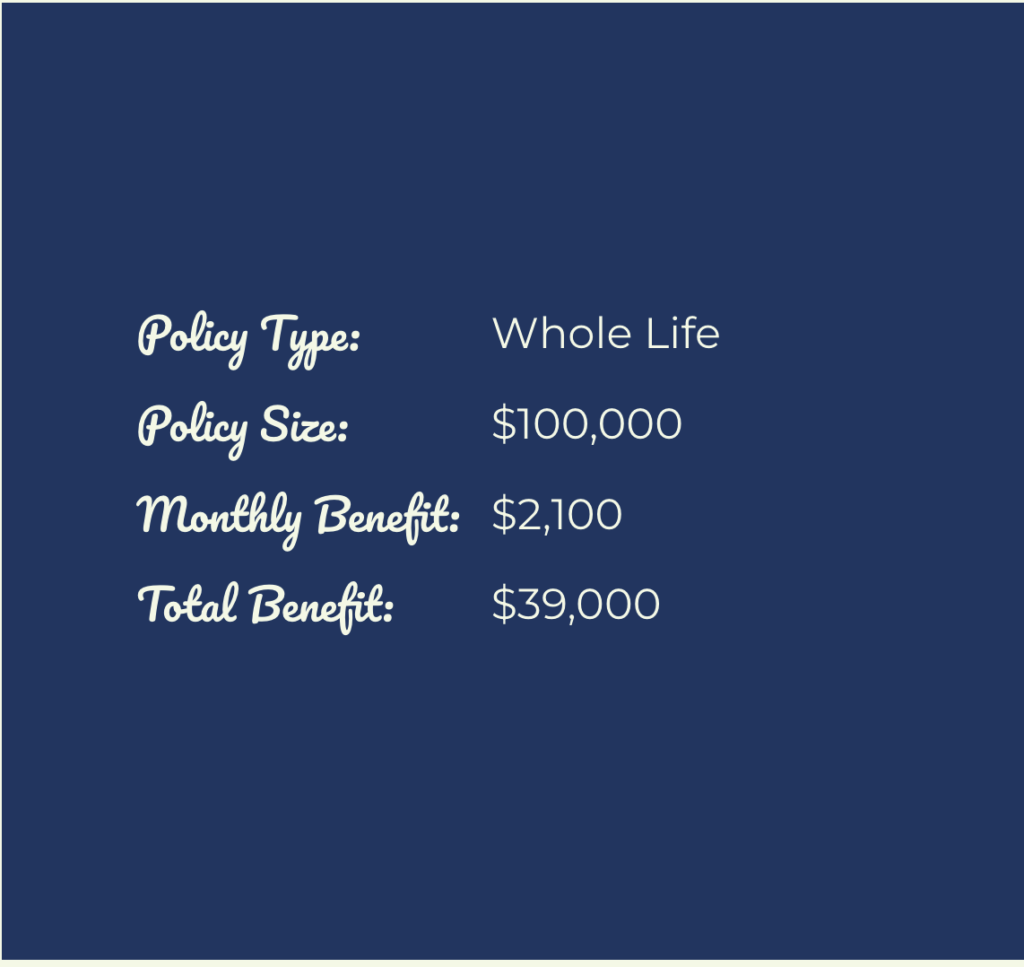

Adding to the pressure, his mother’s $100,000 Whole Life policy had run out of cash and was going to lapse if they did not immediately make an expensive premium payment.

After exhausting other avenues, he contacted Retirement Genius. We were able to expedite the settlement and enabled the family to receive a monthly $2,100 payment that he used to help fund Senior Care for his mother.

Husband and Wife Fund Senior Care Needs

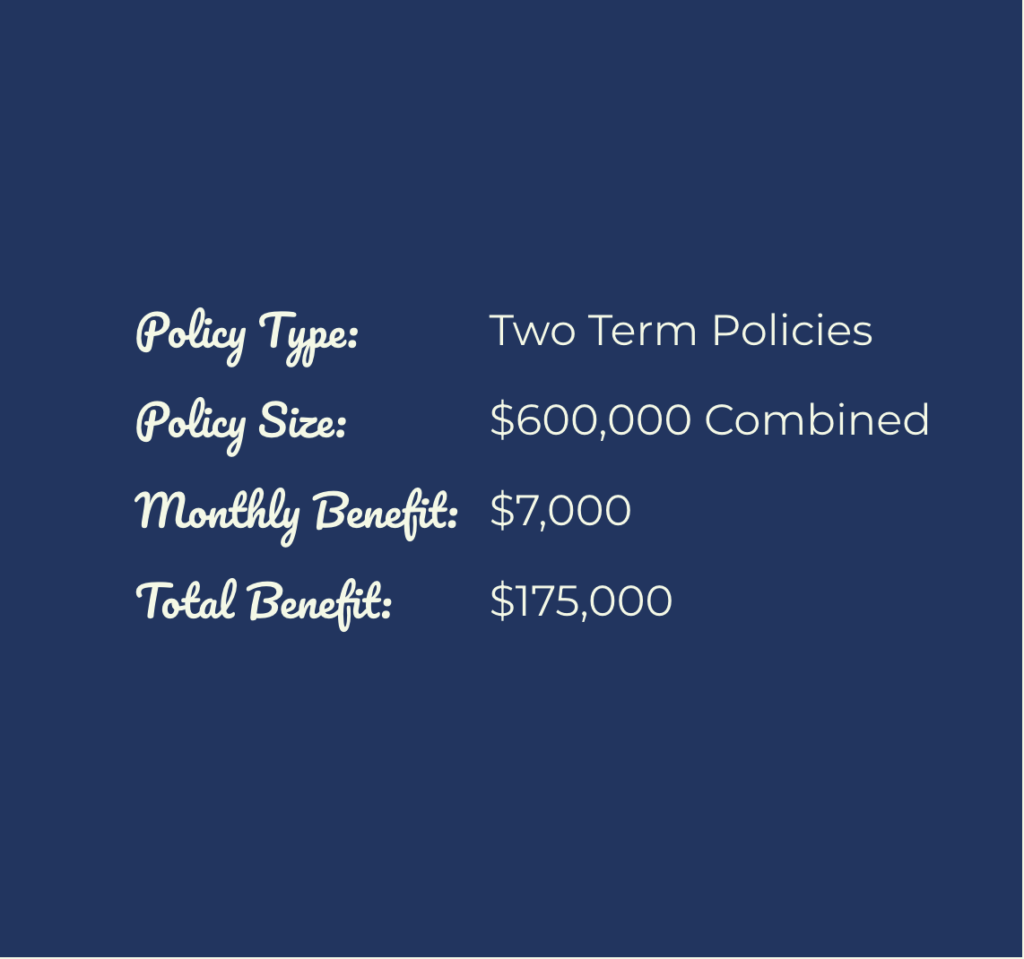

A husband and wife each owned $300,000 term life policies. They were beyond the policy conversion deadline and the premiums had become too expensive for them to maintain. Not knowing they had other options, they stopped paying premiums.

When their advisor contacted Retirement Genius and learned the policies could be sold to fund their Senior Care needs, the couple quickly paid the premiums and the policy was re-instated.

We were able to help them receive a combined $175,000 total benefit from their two $300,000 term life policies they were otherwise lapsing for nothing

Frequently Asked Questions

The Benefit Account will pay the following monthly expenses directly to the health care provider:

- Home Care

- In-Home Nursing/Health Care

- Assisted Living

- Memory Care

- Nursing Home

- Hospice Care

No, they are very different. A person who would qualify to settle their policy for the Benefit Account would be an automatic decline for any form of insurance coverage. Also, there are no wait periods, claims, or limitations on forms of care or the amount that can be spent on a monthly basis from the Benefit Account. The settlement can be split between a lump-sum cash payment and a deposit into the Benefit Account.

No, there are no fees associated with the Long-Term Care Benefit Account. Once a policy is settled by the owner, the benefit payments begin immediately, and the enrollee is relieved of any responsibility to pay premiums.

Should the enrollee pass away with additional funds remaining in their Benefit Account, the remaining balance is paid directly to the enrollee’s named beneficiaries (tax-free if they are below the estate tax exemption level of $11.58M). Enrollees and/or their beneficiaries are assured to receive the full benefit amount even if the client dies before all monthly payments have been made.

Yes, through the life settlement process the enrollee will exchange all ownership and beneficiary rights to the life insurance policy to receive the funds to enroll in the Benefit Account. From the moment the Account is established, it will begin making monthly payments to the selected health care provider. The enrollee is no longer responsible for premium payments, and the policy is no longer considered an asset that will count against them for future Medicaid eligibility.

The policy transaction is specifically designed to conform to the secondary market regulations that govern life settlements, and the benefit is administered specifically to be a Medicaid qualified spend-down of the asset proceeds. By obtaining the fair market value for the life policy, and then at the direction of the policyowner putting the funds into an irrevocable, FDIC insured bank account which can only be administered by a third-party to pay for Medicaid or Medicare qualified long-term care services. The Benefit Account is a regulated financial transaction, and it’s a Medicaid qualified financial vehicle to help cover the costs of long-term care.

The Benefit Account is an irrevocable FDIC insured bank trust account held by a nationally chartered Bank & Trust administered to ensure that the funds are protected and only used for the recipient of care. The account charges no fees, and it is non-interest bearing. The account also has the added protection of paying any remaining balance to a named account beneficiary.

First introduced into the market in 2007, the Long-Term Care Benefit Account is available in all 50 states, enjoys tremendous support from political leaders across the country, is accepted by all forms of senior living and long-term care providers, and has been used to pay millions of dollars in senior care.

Yes, over the last decade there has been legislative action in the states and Washington D.C. to propel forward the use of life settlements to pay for senior living and long-term care. Laws have been introduced in the states to mandate disclosure to policy owners about their legal right to a life settlement and uses for long-term care, the NAIC has endorsed life settlements to pay for long-term care, and Congress has introduced a bill to create an LTC-HSA called a Senior Health Planning Account (SHPA) modeled after this Long-Term Care Benefit Account structure to pay for long-term care funded with tax-free funds from a life settlement.

Chris Orestis

Chris Orestis, CSA®, is an expert in retirement planning, long term care, and financial health. For more than 25 years, he has helped countless seniors and families navigate the complex world of retirement and long term care.

The founder and President of Retirement Genius, Chris Orestis has traveled the country sharing the secrets to aging with financial and physical health and dignity. The author of several books, he has appeared on countless media programs as an advocate of seniors’ financial well-being.

Now Chris is bringing his expertise directly to you. Retirement Genius is your go-to resource for everything you need to live a happier, healthier, and more fulfilling life throughout your golden years.

Working with Us

Our platform for senior care and long term care advisors enables you to submit policies on your clients’ behalf and equips them with the knowledge to make an informed decision about whether to sell their life insurance policy and gain an understanding of its worth. We make life settlements easy with a simple 3-step white-glove process.

- Submit Information

- Policy Analysis

- Results

Submit information about the life insurance policy and the insured.

We evaluate the information to determine life settlement eligibility.

A life settlement expert will present a policy evaluation and settlement estimate.

Get Started

"*" indicates required fields